- by Valerie Jones

Disclaimer: I am not a financial advisor of any kind, nor do I receive compensation for mention of specific goods and services. Do not rely on this post alone to protect you from the breach, seek out information on your own. This is about what I've personally researched and experienced.

UPDATE October 12, 2017: Who knew there were two more agencies where you place security freezes? In the end notes of Michelle Singletary's Washington Post column The Color of Money yesterday, she recommended placing freezes on your credit with the smaller reporting agency Innovis and ChexSystems, a reporting service on how well consumers manage their bank accounts. Both take about 5-10 minutes each and will send you confirmation letters that also explain how to lift the freezes when you need to. Be sure to request the free copy of your credit report from Innovis before you place the security freeze.

This is not just a headache, it’s your time, money and financial future.

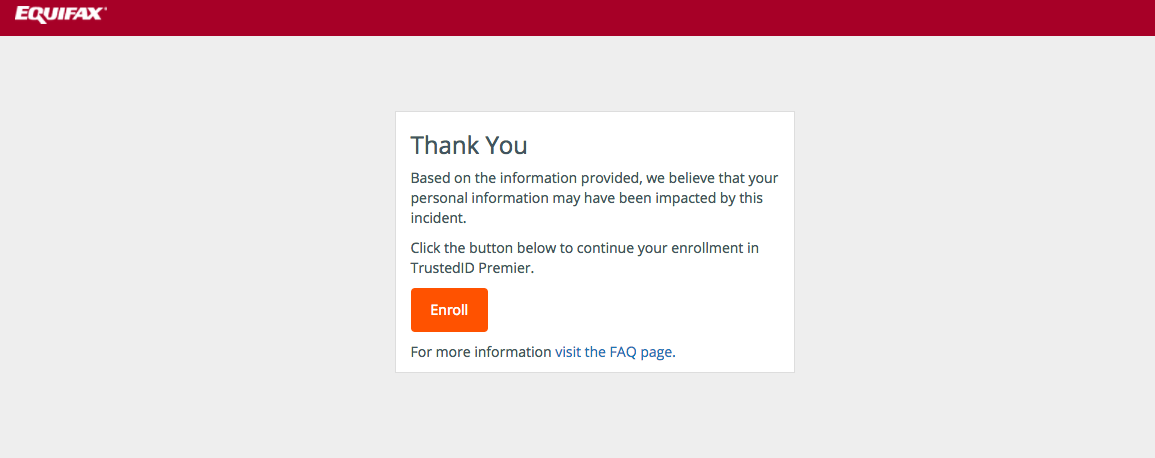

Although the page that allows you to enter your last name and last six digits of your social security number is no longer active, here’s what I saw:

Great, right? Now what... I researched this pretty thoroughly.

Download credit reports: I went online and download free copies from all three services.

At https://www.annualcreditreport.com I followed the prompts. If you're told there's a fee, you're on the wrong site. By federal law, we are all entitled one free copy from all three at no cost, once a year.

While online, I reviewed in detail to make sure there are no errors. If there are, call and get them corrected. The online correction request form was, in my experience, unreliable. Only one of my three had an error which took about a half hour on the phone with Experian to fix. I cannot stress enough how important this is. Errors can affect your creditworthiness in the eyes of lenders. Any mistakes or missing information can affect your FICO score.

After downloading all three, I stored them on my computer and backed them up. Each has a different command to print or save as PDF. It's a bit of a hassle. If you're not sure how to do that it may help to have some assistance from a computer-savvy person.

Freeze your credit: Just to make sure you understand the gravity of the situation, what a freeze is, and have some motivation to take action, consider this excerpt from an article in the L.A. Times "Here are all the ways the Equifax breach is worse than you think."

"Security experts recommend going beyond signing up for account monitoring services, and placing a security freeze on your credit lines. This can be done through Equifax and the other agencies, though there may be a fee. The freeze prevents anyone from opening a new credit or loan account in your name. That includes you, however, which means you have to lift the freeze when you wish to open a new account yourself, and reimpose it (possibly incurring another fee) afterward. That’s an inconvenience, but a worthwhile one to protect your credit, the experts say."

Here's how I froze mine:

1. I called all three services. Depending on the state you live in, you may be required to pay a fee to freeze and if you need a creditor (buying a house, car, insurance, etc.) to check your credit, you'll have to unfreeze which may also cost. In Virginia, I paid $10 each to freeze Experian and TransUnion, and nothing to freeze Equifax (thanks, but too little too late). If government and consumer lawsuits are successful those fees may be refunded. In my mind, it's worth it.

I was able to set these up without having to talk to anyone. I learned to have a PIN # in mind for these two:

|

Experian |

800-493-1058 |

|

TransUnion |

800-916-8800 |

For Equifax, you won't be able to specify a PIN, they assign you one (should we trust a PIN from them?) and read it fast, be ready to write it down. I missed it the first time, and it's not easy to get their computer voice system to repeat it.

|

Equifax |

800-349-9960 |

2. They are supposed to send follow-up letters to let users know it's complete. Experian's arrived in three days. The others, I'm still waiting.

Read our blog post "Equifax breach: What did they know and when did they know it?"

Think carefully about signing up for a monitoring service, free from Equifax or other: In the L.A. Times article, it links to Consumer Reports who says you should consider signing up for a credit monitoring service, but I'm still evaluating that and if I did sign up, I wouldn't consider Equifax's free-for-a-year "TrustedID Premier." There are delays, reports of non-confirmation and other problems trying to sign up. This does not inspire confidence.

Washington Post financial columnist Michelle Singletary wrote this: "I finally got the Equifax credit monitoring service. I still don't feel safe."

Equifax's credit report monitoring site is also vulnerable to hacking https://t.co/fXStlTBd0P

— Moix Security (@moixsec) September 19, 2017

And then there's this about another service ... frequently advertised LifeLock uses Equifax data to monitor credit! Seriously.

The Equifax folks should be in jail. Maybe the Lifelock folks as well. https://t.co/WL7ljYqYgN

— John Dean (@JohnWDean) September 19, 2017

Change your passwords: It's a pain, but it's necessary and I'm not taking any chances. I changed them for all my financial accounts, banks, investments, credit accounts, etc. Consider a password management program. I use 1Password that not only stores them but makes them available, by encrypted password, on all my devices. It also will generate passwords that meet certain criteria.

Here's some good advice from WIRED magazine- hang in there through the ad pre-roll, it's worth it.

Set alerts for financial accounts: My bank and other accounts allow me to set alerts to anytime there's a transaction on my checking, savings or other accounts above a certain amount.

Plan ahead for buying a house or other situations where you would need to unfreeze, then re-freeze your credit: According to the Wall Street Journal, the increasing amounts of consumers freezing their credit reports will likely slow down the “fast loans” and checks for identity theft that have become ubiquitous in recent years.

We’ve become comfortable and expectant of nearly instant approval for home, small business and personal loans. Experts interviewed by the WSJ say the entire lending process will be affected by the Equifax hack. Plan ahead, folks.

Check your banking and credit card statements frequently: Who bought Legos-by-mail and Nikes in New York on my accounts? Or an expensive telescopes in England? Who was charging gas in Arizona, buying Western Union cash cards in Texas, and shopping at WalMart in Florida? All at the same time? This actually happened to me, and the cards had never been out of my possession. The only thing I could think of is that I read my card number to a store including expiration date when I couldn't order online. Did that employee use or sell my number? Thankfully, the bank caught the fraud each of these times and I wasn't liable. But I had to have new cards issued.

Set travel alerts for when you are away from home: You can do this by phone but I find it easier to do it on the bank or other account's phone app. After they blocked my purchase of Thanksgiving dinner fixings at a California grocery store, I was convinced setting travel alerts was worth it. Nothing like having your card not work in a busy grocery store checkout line, but it did get worked out.

Here's a chilling quote from Washington Post's Liz Weston October 3 article, "Equifax just changed the rest of your life":

Credit freezes lock down your credit reports in a way that should prevent “new account fraud,” or bogus accounts being opened in your name. But there are so many other ways the bad guys can use the information they stole, which included Social Security numbers, birthdates, addresses and some driver’s license numbers. Others include:

- Stealing your tax refund and preventing you from filing returns by submitting fake ones

- Using your information to get health care, which can result not only in medical collections on your credit reports but a stranger’s health information getting mixed in with your records

- Giving your identification to the police when they get arrested, creating criminal records that could land you in jail or prevent you from getting a job

- Filing for bankruptcy in your name or transferring deeds of property you own

How about this, from Singletary in "If you expect to get Social Security, this is the one thing to do in the aftermath of the Equifax breach":

You need to go online and open a my Social Security account. Do this before someone uses your stolen information to hijack this extremely important portal for your Social Security benefits.

As the Motley Fool’s Maurie Backman points out, “Someone could, in theory, access your information at some point or another, file for benefits as you (either immediately or once you become eligible), direct those benefits to a new address, and collect them for years with you none the wiser. Then, when you finally decide it’s time to file for benefits, you’ll learn that you have supposedly been receiving them for years.”You can’t prevent any of these bad things from happening. The best you can do is remain as vigilant as you can and try to clear up the messes as they happen.Armed with publicly available information and data stolen in the Equifax breach — your address, Social Security, driver’s license and credit card numbers — identity thieves could have enough to get through the security to set up an online Social Security account.

Americans are worried about the Equifax hack. They're just not doing much about it, a poll suggests. https://t.co/k1HMIk2giE pic.twitter.com/rcPW9N4Ill

— CNN (@CNN) September 20, 2017